maraboom.ru Tools

Tools

How Much To Open A Checking Account At Pnc

What are the requirements to open a student bank account with PNC. You can open a PNC student account if you're over 16 and have a US government issued ID. If. PNC WorkPlace Banking checking account must remain open in order for you to receive the $ reward, which will be credited to the eligible checking account. Minimum deposit to open: $0 · Minimum to earn interest: $1 · Monthly Service charge of $5, or $0 if one of the following is met: Average monthly balance of $ You'll pay no monthly service fees, and the account has no minimum initial deposit or balance requirements. CD options include terms from seven days to 10 years. Students, you have the option to open an account with PNC Bank. You may then choose to link your PNC account to your i-card. No account interest for checking (Spend) · No minimum opening deposit · Insured by FDIC (Federal Deposit Insurance Corporation) · 60, ATMs with $5 out-of-. Customers with a PNC consumer checking, savings, money market, certificate of deposit (CD) or retirement money market or CD account are not charged this fee. PNC's Virtual Wallet With Performance Spend requires that you have just $25 in your Spend account to open it, or $0 if you open it online. There's a $15 monthly. PNC requires a $25 minimum opening deposit for their various different checking accounts, with different ones having different monthly service fees, ranging. What are the requirements to open a student bank account with PNC. You can open a PNC student account if you're over 16 and have a US government issued ID. If. PNC WorkPlace Banking checking account must remain open in order for you to receive the $ reward, which will be credited to the eligible checking account. Minimum deposit to open: $0 · Minimum to earn interest: $1 · Monthly Service charge of $5, or $0 if one of the following is met: Average monthly balance of $ You'll pay no monthly service fees, and the account has no minimum initial deposit or balance requirements. CD options include terms from seven days to 10 years. Students, you have the option to open an account with PNC Bank. You may then choose to link your PNC account to your i-card. No account interest for checking (Spend) · No minimum opening deposit · Insured by FDIC (Federal Deposit Insurance Corporation) · 60, ATMs with $5 out-of-. Customers with a PNC consumer checking, savings, money market, certificate of deposit (CD) or retirement money market or CD account are not charged this fee. PNC's Virtual Wallet With Performance Spend requires that you have just $25 in your Spend account to open it, or $0 if you open it online. There's a $15 monthly. PNC requires a $25 minimum opening deposit for their various different checking accounts, with different ones having different monthly service fees, ranging.

Every business needs a good foundation, starting with a PNC business checking account. · Business Checking · Business Checking Plus · Treasury Enterprise Plan. The Reserve and Growth accounts do not have opening deposits or Monthly Service Fees. Cash withdrawals at non-PNC ATMs in the U.S. cost $3 per withdrawal, while. Business Checking Account - $ Bonus Open a new PNC Treasury Enterprise Plan or Analysis Business Checking account. Maintain an average ledger balance of. No Minimum Balance. Apply online. If approved, fund your account and start growing your savings. Member FDIC. Deposits are insured up to. Minimum to open, $0 ; Monthly service charge, $5 ; Monthly service charge for account holders age 62+ · $0 ; Cashier's Checks, $0 ; Overdraft and returned item fee. $10, combined average monthly balance across the PNC Bank consumer PNC WorkPlace Banking checking account must remain open in order for you to. PNC also offers the Virtual Wallet Checking Pro, which combines your savings and checking accounts. There's no minimum initial deposit requirement, minimum. You may earn a $ reward if you open and use a new Virtual Wallet with Performance Select, a $ reward if you open and use a new Virtual Wallet with. One of the following must be met: $ average monthly balance in account; Under the age of 18; At least one monthly auto savings transfer of $25 or more; When. No monthly service charge. Must be combined with Virtual Wallet Spend & Reserve checking accounts. One of the following must be met: $ average monthly. To start your application, please call us at between the hours of a.m. and p.m. ET, Monday through Friday. Have Questions? We're here. 17 votes, 29 comments. I got a decent offer to open a checking account through PNC and they seem to have some pretty good features. To receive $1, Open a new PNC Treasury Enterprise Plan (including Analysis Business Checking) account. To qualify for the reward, the new checking account. Earn up to $ from PNC Bank for opening a new Virtual Wallet® account. Full details below! At no extra cost to you, some or all of the products featured. No minimum initial deposit. There is no minimum balance required to open an account online. PNC Bank checking account Pros & Cons. Pros. $25 to open an account (savings) that stays with them (it's your “buy in” that you get back when closing the account) and $25 to open a checking. The performance select checking account from PNC Bank has a $25 monthly service fee, while the interest checking account has a $13 service fee. Debit cards and. Check balances & recent transactions – See current account activity for your checking, savings, credit card and loan accounts. The Monthly Account Maintenance Fee will be waived on up to four beneficiary checking accounts. You have the option to add more than four beneficiary accounts. Three accounts - Spend (primary checking), Reserve (short-term planning), and Growth (savings) accounts - all rolled into one. Banking Built for Students. A.

Best Water Flosser Under $50

:max_bytes(150000):strip_icc()/mysmile-cordless-water-flosser-c2dfcdcf9a3949789030f4e519db6eaa.png)

It's much less hands on, and less technique intensive. The Oral-B Water Flosser Advanced Cordless Irrigator is designed to deep clean and detoxify* below the. We use cookies to provide you with the best online experience. If you Under $25 · Under $50 · Under $ · Under $ · Under $ · Over $ · Shop All. Our Top Picks · Best Overall: Aquasonic Aqua Flosser · Best Waterpik: Waterpik Aquarius Water Flosser · Best Cordless: Waterpik Cordless Plus Water Flosser · Best. We use cookies to provide you with the best online experience. If you Under $25 · Under $50 · Under $ · Under $ · Under $ · Over $ · Shop All. The Waterpik Cordless Water Flosser WP is a portable unit with rechargeable battery. The easy and more effective way to floss. Description + - · Oral-B Water Flosser Advanced, Portable Oral Irrigator Handle. Oral-B Water Flosser Advanced deep cleans and detoxifies* below the gumline. Plus a four week battery life, Curve Sonic Toothbrush - Black. From. $ $ “This water flosser is a great addition to my oral care routine! It's. With its retail price of about $50, the Aquasonic Aqua Flosser Standard is significantly more affordable than the other models on our list. best water flosser. Cordless Water Flosser; Floss, Gum, & Mints. Shop now. Fresh refills delivered The quip Adult Sonic Toothbrush in Green. Best seller · Sonic Toothbrush. It's much less hands on, and less technique intensive. The Oral-B Water Flosser Advanced Cordless Irrigator is designed to deep clean and detoxify* below the. We use cookies to provide you with the best online experience. If you Under $25 · Under $50 · Under $ · Under $ · Under $ · Over $ · Shop All. Our Top Picks · Best Overall: Aquasonic Aqua Flosser · Best Waterpik: Waterpik Aquarius Water Flosser · Best Cordless: Waterpik Cordless Plus Water Flosser · Best. We use cookies to provide you with the best online experience. If you Under $25 · Under $50 · Under $ · Under $ · Under $ · Over $ · Shop All. The Waterpik Cordless Water Flosser WP is a portable unit with rechargeable battery. The easy and more effective way to floss. Description + - · Oral-B Water Flosser Advanced, Portable Oral Irrigator Handle. Oral-B Water Flosser Advanced deep cleans and detoxifies* below the gumline. Plus a four week battery life, Curve Sonic Toothbrush - Black. From. $ $ “This water flosser is a great addition to my oral care routine! It's. With its retail price of about $50, the Aquasonic Aqua Flosser Standard is significantly more affordable than the other models on our list. best water flosser. Cordless Water Flosser; Floss, Gum, & Mints. Shop now. Fresh refills delivered The quip Adult Sonic Toothbrush in Green. Best seller · Sonic Toothbrush.

The Waterpik Water Flosser is an innovative oral hygiene device designed to enhance dental care routines. This category encompasses a range of flossers that. $ A tube of quip anticavity fluoride toothpaste in mint flavor First, the size of the water flosser is great. As you can see, it fits in. We use cookies to provide you with the best online experience. If you Under $50 · Under $ · Under $ · Over $ · Shop All. Shop. Personal Care · Acne. Best Fit For You. maraboom.ru__PID:9cdbdc6-bdd37c0c9c2 under the gumline, ensuring a confident smile and optimal oral health. Best Sellers · Shop By Price. Expand submenu Shop By Price Collapse submenu Shop By Price. Under $10 · $10 - $25 · $25 - $50 · $50 - $75 · $75 - $ · Track. This is the portable water jet flosser that helps you maintain your oral hygiene routine when traveling. It removes plaque, fights gingivitis, and cleans. $ $ / 1 ct. COSLUS Water Dental Flosser T ; $ $ / 1 ct. Waterpik Complete Care 9. ; $ $ / 1 ct. Water Dental Flosser Cordles. The Burst cordless water flosser costs just $, making it one of the best deals on the market for a name-brand device. I typically recommend Burst. $30 Water Flosser for a Clean and Fresh Smile. Discover the power of water flossing with our affordable $30 water flosser! Say goodbye to. Best Buy Business · Français. Cancel. Home · Personal Care · Oral Care · Water Flosser ( Reviews). $ $ SAVE $ $ - $ Current price $ | /. Flosmore® FL01 Cordless Water Water flossing is the best way to keep your oral cavity clean and healthy. Waterpik® is the #1 recommended water flosser brand among Dental Professionals. This model comes with 6 flossing tips and 10 pressure settings. Easy, effective. Rechargeable and portable, the Waterpik Cordless Plus water flosser (WP) is a great choice for smaller bathrooms or for travel. It offers an ultra-quiet. $ Waterpik ION Cordless Counter ; $ $ Waterpik - Sonic-Fusion - Black ; $ $ Aquasonic - Elite - Portable Cordles. Cordless Water Flosser; Floss, Gum, & Mints. Shop now. Fresh refills delivered The quip Adult Sonic Toothbrush in Green. Best seller · Sonic Toothbrush. Lowest price for Waterpik Ultra Water Flosser is $ This is currently the cheapest offer among 15 stores. Compare: Waterpik Electric Toothbrushes &. This is the portable water jet flosser that helps you maintain your oral hygiene routine when traveling. It removes plaque, fights gingivitis, and cleans. Water Pik · Ambry Kruger · Braces Care ; Waterpik Cordless Advanced Water Flosser For Teeth · divinely guided · Bathroom Ideas ; Cordless Waterpik under $50 · Ariel. The Waterpik water flosser uses technology to create an effective combination of water pressure and pulsations, cleaning deep between teeth and below the.

Ebitda Definition

:max_bytes(150000):strip_icc()/ebitda-final-acc54b87f5944495a720acb8e2fd3b78.png)

EBITDA is a measure of a company's net income – also known as earnings or profit – with non-cash expenses added back to operating income. EBITDA is an acronym that stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. It's a financial metric used to evaluate a company's. EBITDA stands for earnings before interest, taxes, depreciation, and amortization. EBITDA is a useful metric for understanding a business's ability to generate. Example of EBITDA There are two ways to perform the EBITDA calculation. The first EBITDA formula is: Net Income + Taxes + Interest Expenses + Depreciation +. (iii) the measure is defined as operating profit plus depreciation and amortisation. The presentation of such a subtotal is illustrated in Appendix D. Requiring. Let's start with the definition of EBITDA: Earnings Before Interest Tax Depreciation and Amortization. This process is often used as a proxy for cash flow and. A company's earnings before interest, taxes, depreciation, and amortization is a measure of a company's profitability of the operating business only. EBITDA means earnings before interest, taxes, depreciation, and amortization. Know its formula, calculations, advantages, and more. It stands for earnings before interest, taxes, depreciation, and amortisation. To understand what each part of this means, see How to calculate EBITDA below. As. EBITDA is a measure of a company's net income – also known as earnings or profit – with non-cash expenses added back to operating income. EBITDA is an acronym that stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. It's a financial metric used to evaluate a company's. EBITDA stands for earnings before interest, taxes, depreciation, and amortization. EBITDA is a useful metric for understanding a business's ability to generate. Example of EBITDA There are two ways to perform the EBITDA calculation. The first EBITDA formula is: Net Income + Taxes + Interest Expenses + Depreciation +. (iii) the measure is defined as operating profit plus depreciation and amortisation. The presentation of such a subtotal is illustrated in Appendix D. Requiring. Let's start with the definition of EBITDA: Earnings Before Interest Tax Depreciation and Amortization. This process is often used as a proxy for cash flow and. A company's earnings before interest, taxes, depreciation, and amortization is a measure of a company's profitability of the operating business only. EBITDA means earnings before interest, taxes, depreciation, and amortization. Know its formula, calculations, advantages, and more. It stands for earnings before interest, taxes, depreciation, and amortisation. To understand what each part of this means, see How to calculate EBITDA below. As.

(iii) the measure is defined as operating profit plus depreciation and amortisation. The presentation of such a subtotal is illustrated in Appendix D. Requiring. EBITDA stands for Earnings, Before Interest, Taxes, and Depreciation. EBITDA is one of the most common Profit metrics in the Finance world. Definition: EBITDA is an abbreviation used in accounting that stands for "Earnings before interest, taxes, depreciation, and amortization. What is EBITDA? – Definition and Explanation. EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. It is a financial metric used. EBITDA or Earnings Before Interest, Tax, Depreciation, Amortization is a company's profits before any of these net deductions are made. Now, we had an EBITDA profit of 60 million and a net profit of 10 million. The company has managed in three years to boost sales by nearly percent while. EBITDA stands for Earnings Before Interest, Tax, Depreciation, and Amortization. Find out what this metric is, and how to calculate it! Adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization) is a measure computed for a company that takes its earnings and adds back. Example EBITDA calculation A company's income statement shows net profit: $,, interest of $50,, taxation of $,, depreciation of $80, and. EBITDA means earnings before interest, taxes, depreciation and amortization. Sample 1Sample 2Sample 3. It is a non- GAAP calculation based on data from a company's income statement used to measure a company's operating profitability. Earnings before interest, taxes, depreciation and amortization (EBITDA) is a business analysis metric. Learn how to analyze your company's financial health with. EBITDA stands for 'earnings before interest, taxes, depreciation and amortisation'. Find out all about this measure of a company's net income. EBITDAR: Earnings before interest, taxes, depreciation, amortization and restructuring/rent. This calculation adds to the classic EBITDA by including any costs. EBITDA is calculated by adding four items back to net profits (or earnings). It's used as a measure of the cash a business generates. What does the abbreviation EBITDA stand for? Meaning: earnings before interest, taxes, depreciation, and amortization. EBITDA is the earnings before interest, taxes, depreciation, and amortization, calculated by adding the net income, interest, taxes, depreciation, and. EBITDA meaning: abbreviation for Earnings Before Interest, Tax, Depreciation, and Amortization: a company's profits. Learn more. EBITDA Definition: EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) is a proxy for a company's core, recurring business cash flow from. EBITDA is a statistic used to assess a company's operating performance. It is a proxy for the cash flow generated by its complete operations.

How Much Home Can I Afford With 30k A Year

To determine how much you can afford for your monthly mortgage payment, just multiply your annual salary by and divide the total by This will give. Use our convenient calculator to figure your ratio. This information can help you decide how much money you can afford to borrow for a house or a new car. How much house can I buy on $35k per year? An annual household income of $35, means you earn about $2, a month before taxes and other deductions come out. Learn more about mortgages. · How do I make an offer on a house? · First time home buyer tips · How much house can I afford? · Take the next step. To get the best mortgage loan, know how much you can afford and shop like the bargain hunter you are. by Hal M. Bundrick, CFP®, Phil Metzger. Here's how much mortgage you can afford: Based on a 5-year fixed mortgage with 25 year amortization and % interest rate. Your mortgage payment should be 28% or less. Your debt-to-income ratio (DTI) should be 36% or less. Your housing expenses should be 29% or less. -- The sum of the monthly mortgage and monthly tax payments must be less than 31% of your gross (pre-taxes) monthly salary. -- The sum of the monthly mortgage. Ideally all of your monthly expenses, such as minimum monthly payments, food, Utilities, etc. should land around 50% of your net income. Leaves. To determine how much you can afford for your monthly mortgage payment, just multiply your annual salary by and divide the total by This will give. Use our convenient calculator to figure your ratio. This information can help you decide how much money you can afford to borrow for a house or a new car. How much house can I buy on $35k per year? An annual household income of $35, means you earn about $2, a month before taxes and other deductions come out. Learn more about mortgages. · How do I make an offer on a house? · First time home buyer tips · How much house can I afford? · Take the next step. To get the best mortgage loan, know how much you can afford and shop like the bargain hunter you are. by Hal M. Bundrick, CFP®, Phil Metzger. Here's how much mortgage you can afford: Based on a 5-year fixed mortgage with 25 year amortization and % interest rate. Your mortgage payment should be 28% or less. Your debt-to-income ratio (DTI) should be 36% or less. Your housing expenses should be 29% or less. -- The sum of the monthly mortgage and monthly tax payments must be less than 31% of your gross (pre-taxes) monthly salary. -- The sum of the monthly mortgage. Ideally all of your monthly expenses, such as minimum monthly payments, food, Utilities, etc. should land around 50% of your net income. Leaves.

If you're debt-free, your monthly housing payment can go as high as $1, on an income of $50, per year. Author. By Amy Fontinelle. Amy Fontinelle. How much do I need to make to afford a $, home? And how much can I Mortgage insurance typically costs – percent of your loan amount per year. To calculate how much home you can afford with a VA loan, VA lenders will Top VA Purchase Lender each Fiscal Year between Source. The 28% rule says that your monthly housing payment should be no more than 28% of your household's monthly income. Salary / 12 x = your max housing. Use the LendingTree home affordability calculator to help you analyze multiple scenarios and mortgage types to find out how much house you can afford. Enter your details below to estimate your monthly mortgage payment with taxes, fees and insurance. Not sure how much you can afford? Try our home affordability. The affordability calculator will help you to determine how much house you can afford. The calculator tests your entries against mortgage industry standards. Income multipliers are a starting point for determining how much you can borrow for a mortgage. On a salary of £30, per year, most mortgage lenders in. Mortgage Term: We assume a year fixed mortgage term. Mortgage Type Loan How much house can you afford? Calculate your monthly mortgage payment. “I have $30K, what home can I afford to buy?” This is just a rough figure based on a 7% interest rate and % property tax rate. There are many other. This rule asserts that you do not want to spend more than 28% of your monthly income on housing-related expenses and not spend more than 36% of your income. How much money do you make each year? Rule of thumb says that your monthly home loan payment shouldn't total more than 28% of your gross monthly income. Gross. Know these terms & how they work. The 28/36 rule. This is a common-sense rule to calculate how much debt you should assume. How it works: Your total housing. Most lenders do not want your total debts, including your mortgage, to be more than 36 percent of your gross monthly income. Determining your monthly mortgage. A typical limit is 41% - 45% of your monthly income, but this can vary by loan type and other determining factors such as down payment, term, credit score, and. The best way to think about how much home you can afford is to consider what your maximum monthly mortgage can be. As a general rule of thumb, lenders limit. Here's how much mortgage you can afford: Based on a 5-year fixed mortgage with 25 year amortization and % interest rate. Calculate loan amounts and mortgage payments for two scenarios; one using aggressive underwriting guidelines and another using conservative guidelines. Can I buy a house if I make 30k a year? Whether you are able to purchase a home with $30, a year will greatly depend on where you live. In many of the more. To afford a house that costs $30, with a down payment of $6,, you'd need to earn $6, per year before tax. The mortgage payment would be $ / month.

What Credit Card Is Right For Me

Checklist of what to look out for when choosing a credit card · Annual Percentage Rate (APR). This is the cost of borrowing on the card, if you don't pay the. Find the credit card that's right for you from among our most popular credit cards. It's easy to apply online. Find the best credit cards by comparing a variety of offers for balance transfers, rewards, low interest, and more. Apply online at maraboom.ru Is a rewards credit card a good choice? Rewards cards can sometimes have higher interest rates and/or higher annual fees. Identify the trade-offs and weigh. Consider what purchases you plan to make and check your credit score, then review current welcome offers, rewards and benefits of a potential new card. If you have good credit, consider cards that state good or fair credit requirements. Even if your credit score falls within the good range that doesn't. U.S. News evaluated hundreds of credit card offers and selected the best credit cards for every type of consumer. Overall. BEST CREDIT CARD OVERALL · 0% INTRO APR. Best 0% APR Credit Card Overall · BALANCE TRANSFERS. Best Balance Transfer Credit Card for Good Credit · REWARDS. Which credit card is best for me? · 1. Check your credit score · 2. Whittle down your card options · 3. Read the fine print · 4. Apply for the card that best meets. Checklist of what to look out for when choosing a credit card · Annual Percentage Rate (APR). This is the cost of borrowing on the card, if you don't pay the. Find the credit card that's right for you from among our most popular credit cards. It's easy to apply online. Find the best credit cards by comparing a variety of offers for balance transfers, rewards, low interest, and more. Apply online at maraboom.ru Is a rewards credit card a good choice? Rewards cards can sometimes have higher interest rates and/or higher annual fees. Identify the trade-offs and weigh. Consider what purchases you plan to make and check your credit score, then review current welcome offers, rewards and benefits of a potential new card. If you have good credit, consider cards that state good or fair credit requirements. Even if your credit score falls within the good range that doesn't. U.S. News evaluated hundreds of credit card offers and selected the best credit cards for every type of consumer. Overall. BEST CREDIT CARD OVERALL · 0% INTRO APR. Best 0% APR Credit Card Overall · BALANCE TRANSFERS. Best Balance Transfer Credit Card for Good Credit · REWARDS. Which credit card is best for me? · 1. Check your credit score · 2. Whittle down your card options · 3. Read the fine print · 4. Apply for the card that best meets.

Credit-building cards. These are a great choice if you have no credit history and are also perfect for people rebuilding their credit. · Student credit cards. To choose the best credit card for you, consider your spending habits and how you will pay it off. If you're struggling to pay your bills, a new credit card. Recommended Credit Score: Good - Excellent · Rewards: 5X points on up to $, per calendar year spent on directly booked airfare, flights and prepaid. We choose from of the top travel and cash rewards credit cards based on your spending habits and lifestyle. Find the best credit card offers and apply today. Take an honest look at your credit score and your spending. Look over the cards that may be available to you and choose the one that best fits your spending. NerdWallet's credit card quiz helps you find the right credit card to meet your goals. Compare cash back, low-interest, rewards cards, and more! Get started with everyday Cards If it's your first Credit Card and you are trying to figure out, how do I choose the right Credit Card, you might want to look. Certain types of cards can help you build credit if you're just starting out, or they can help you rebuild credit if you've had a financial setback. As you use. Choosing the right type of credit card could save you money in interest, earn you rewards or help you get accepted for borrowing in the future. 1. Check your credit score · 2. Identify which type of credit card you want · 3. Look at your spending habits · 4. Shop around and apply for what offers the most. The first step in determining the best credit card to apply for is to figure out where you stand credit-wise. There are credit cards available for people who. Whether you are interested in a lower interest rate, travel rewards, cash back or other perks, we can help you find the right credit card from our partners. Choosing the right type of credit card could save you money in interest, earn you rewards or help you get accepted for borrowing in the future. Credit Card. Good for Car Rental, Hotels; Anywhere Mastercard is Accepted. Get (ME residents no more than $). Foreign transaction fee: 1% of the. Want the best credit card for your wallet? Take this short 3-minute quiz and discover if your card earns you the best rewards, AND saves you the most money. Credit cards offer convenience for managing expenses, allowing you to pay for goods and services over time · Interest is applied to your card spending (account. Checklist of what to look out for when choosing a credit card · Annual Percentage Rate (APR). This is the cost of borrowing on the card, if you don't pay the. Make sure you also generally meet the credit issuer's criteria. It's a good idea to know what your credit score is so that you can target your search to a card. Credit cards can help you improve your credit score, but only if you use them responsibly. Your payment history and borrowing amount are the two biggest. The Bank of America® credit card comparison tool lets you compare credit cards side by side to find the card that's right for your lifestyle.

Get Paid To Read Ebooks

The three main online stores that sell eBooks are Amazon's Kindle Store, Barnes & Noble's Nook Store, and Apple's iBook store. Authors can also sell their books. Earn more with multiple income streams · Earn up to 70% royalties on eBook sales · Earn your share of the KDP Select Global Fund based on your book's pages read. If you get selected, read and then do a survey for the manuscript, you get $25 Amazon per task. Upvote. Sep 24, - Wondering how to get paid to read books? here are 10 of the best websites that pay you real money just to read books. If you start doing book reviews on YouTube, publishers will reach out about you reading their books and you can ask to be paid to promo the book a few times. Start writing book reviews on the books you complete. There are many opportunities to get paid for writing book reviews, one of which is to write reviews. Editorial reviews for books under pages are always free, while those for books over pages are paid at a rate of $10 unless we specify a different amount. I also have some small reservations about authors flooding the market with free books simply because they want to be read and don't care if they don't make any. ACX is a well-known online network for audiobook voice talent. The platform pays individuals to read books aloud. After you register, you need. The three main online stores that sell eBooks are Amazon's Kindle Store, Barnes & Noble's Nook Store, and Apple's iBook store. Authors can also sell their books. Earn more with multiple income streams · Earn up to 70% royalties on eBook sales · Earn your share of the KDP Select Global Fund based on your book's pages read. If you get selected, read and then do a survey for the manuscript, you get $25 Amazon per task. Upvote. Sep 24, - Wondering how to get paid to read books? here are 10 of the best websites that pay you real money just to read books. If you start doing book reviews on YouTube, publishers will reach out about you reading their books and you can ask to be paid to promo the book a few times. Start writing book reviews on the books you complete. There are many opportunities to get paid for writing book reviews, one of which is to write reviews. Editorial reviews for books under pages are always free, while those for books over pages are paid at a rate of $10 unless we specify a different amount. I also have some small reservations about authors flooding the market with free books simply because they want to be read and don't care if they don't make any. ACX is a well-known online network for audiobook voice talent. The platform pays individuals to read books aloud. After you register, you need.

6 Websites To Get Paid To Read Books Aloud · Before you start · ACX · Voice · Bunny Studio · Findaway Voices · Spoken Realms · Voice Jungle. There are several ways to get paid books for your Kindle: 1. Purchase them directly from the Kindle Store: You can buy Kindle books from. Discover a World of Books: Dive into a diverse collection of ebooks, including mysteries, romances, and fantasy epics. Regular updates ensure there's always. In this article, we discuss 10 ways you can get paid to read books and what you need to equip yourself to do so. · 1. Critique Partner · 2. Professional. There are many ways to get paid to read books, from recording audiobooks to writing reviews. Here's how to reward your love of reading with cash. There are many ways to get paid to read books, from recording audiobooks to writing reviews. Here's how to reward your love of reading with cash. Grow your eBook earnings with an audiobook edition. ACX not only makes it easy, you'll have complete control of the production process and distribution across. Audiobook Narration: Record and sell audiobooks through platforms like Audible, ACX, or Findaway Voices. · Book Reviewer: Get paid to write book. Net Galley. Net Galley is a publishing company that needs people to read books online. Whether you are a librarian, bookseller, educator, reviewer, or blogger. Earn While You Read: Top Sites That Pay You for Book Reviews · eBookFairs: This platform stands out not only for its daily payouts but also for its commitment. I also have some small reservations about authors flooding the market with free books simply because they want to be read and don't care if they don't make any. How to make money by reading books · Join BookTok. In the UK (and elsewhere around the world), TikTok has had a huge influence on the reading habits of many. One way to get paid to read is by becoming an online book reviewer. There are many websites and companies that hire people to review books. Sep 24, - Wondering how to get paid to read books? here are 10 of the best websites that pay you real money just to read books. Get paid to read books · Freecash: Get your own free account, complete small tasks, start collecting coins and cash them out. · PineCone Research: Earn $3 – $5. How to Get Paid to Read Books · 1. Find Proofreading or Copy-Editing Gigs. Behind every great author is a solid proofreader. · 2. Kirkus Media · 3. Reedsy. Get paid with your earnings · You must have a local business address and local bank account in at least one of the countries supported for payment, specified in. Get paid for each page read with Kindle Unlimited Earn royalties for each page read on Kindle Unlimited when you enroll your book in KDP Select. · Earn up to 70%. Get Paid to Read Books: 25 Legitimate Sites to Make $/Read · 1. Bunny Studio · 2. Brilliance Publishing · 3. ACX · 4. Voices. Use Apps to Earn: Get Paid. All you have to do is submit a narrating audition and get added to their list of narrators where authors can find you and pay you to narrate!

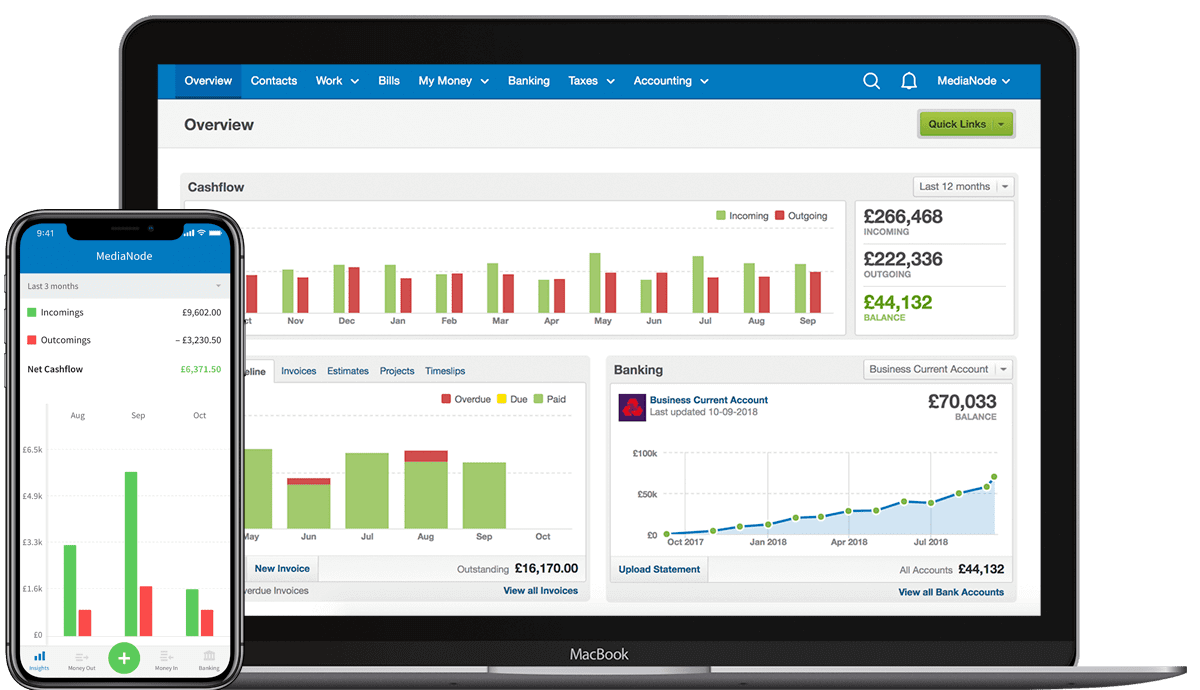

Home And Small Business Accounting Software

For years, QuickBooks has been the trusted choice for accountants — and the end result is the best accounting software for small businesses. The best cloud accounting software for small business includes Financfy, QuickBooks, FreshBooks, Xero and many more. Choose the best fit for your business. We researched top accounting software for small businesses based on function, cost, user-friendliness, and more. QuickBooks Online is our top choice. Shop Best Buy's small business finance and bookkeeping software options for Windows PCs or Mac Home Security Systems · Smart Speakers. Choose accounting small business software with features such as integrated banking, bill pay and payroll for an easy all-in-one solution. If you need to manage. Xero online accounting software for your business connects you to your bank, accountant, bookkeeper, and other business apps. Start a free trial today. FreshBooks is a small business accounting software for business owners. Send custom invoices, track expenses, accept credit cards. Start a free day trial. Small Business Accounting is an accounting app for iPhone, iPad, and Mac. It is easy to use with no registration or login required. We offer flexible accounting plans to fit businesses small and large, across all industries, with integrations like payroll, time-tracking, and payments. For years, QuickBooks has been the trusted choice for accountants — and the end result is the best accounting software for small businesses. The best cloud accounting software for small business includes Financfy, QuickBooks, FreshBooks, Xero and many more. Choose the best fit for your business. We researched top accounting software for small businesses based on function, cost, user-friendliness, and more. QuickBooks Online is our top choice. Shop Best Buy's small business finance and bookkeeping software options for Windows PCs or Mac Home Security Systems · Smart Speakers. Choose accounting small business software with features such as integrated banking, bill pay and payroll for an easy all-in-one solution. If you need to manage. Xero online accounting software for your business connects you to your bank, accountant, bookkeeper, and other business apps. Start a free trial today. FreshBooks is a small business accounting software for business owners. Send custom invoices, track expenses, accept credit cards. Start a free day trial. Small Business Accounting is an accounting app for iPhone, iPad, and Mac. It is easy to use with no registration or login required. We offer flexible accounting plans to fit businesses small and large, across all industries, with integrations like payroll, time-tracking, and payments.

Like QuickBooks, Xero allows for easy integration of multiple business functions' data, helping to automate reporting, reconciliation, payments, and other. Accounting software helps you track how money moves in and out of your small business. Whether you manage a local restaurant or have a private healthcare. The appealing thing about FreshBooks is its intuitive including polished web service. It's a top home business accounting software. It offers improved UX or. The bottom line: Xero is our favorite accounting service for small businesses. With free unlimited users, it's an excellent pick for collaborative businesses. For an annual subscription for small business without payroll but with inventory is $ compared to $ for the desktop versions which last a few years. Free accounting software designed for small businesses with turnover below $50K per annum. From invoicing to business reporting, manage your bookkeeping needs. Xero is a powerful online accounting software solution for small businesses. Run things smoothly, keep tidy online bookkeeping records, and make compliance a. QuickBooks is one of the most popular accounting software programs for small businesses. It's a comprehensive cloud-based software that covers all the basics. If your business is on a tight budget, consider free accounting software. Wave, for instance, provides many of the accounting and invoicing features you would. Online accounting software for small business. Log in to Xero anytime, anywhere to explore easy invoicing, bookkeeping and accounting online. It's just easier when it's organized. Run your home like you'd run your business. Or run a business out of your home. Either way, with QuickBooks you can. Accounting software that works as hard as you do · Get more time for what you love. With the Pro Plan, automatically import, merge, and categorize your bank. Xero, designed for small businesses, accountants, and bookkeepers, conveniently shows outstanding payments, bank records, and cash inflow in its dashboard. Best 9 Accounting Softwares for Small Businesses in · QuickBooks Online – Best Small Business Accounting Software · Tipalti – Best Software for International. Best accounting software. FreshBooks: Best if you want to scale your business. Zoho Books: Most affordable. Intuit QuickBooks Online: Best if you'. Free, open-source, and online accounting software for small businesses and freelancers. Send invoices and track expenses on the cloud. Sage Intacct is a cloud-based accounting software that offers financial reporting, dashboards, smart event/rule automation, and integration with various third-. I have been using Quicken [Classic Business & Personal] for years and it is a reliable way for me to track my home and business expenses, particularly at tax. Sage 50 and Sage Intacct are our accounting solutions that help you manage your business. Sage 50 is perfect for small businesses.

Discount Land Investing Reddit

4 acres of unfinished land is a horrible deal. You should be able to buy 10 acres or more for that price outside of the town. Upvote 2. If so you can get discounted property with roof damage. Do you know a great wholesaler who can give you deals? Do you have a private money. Land is a very long game that may not even pay off in your lifetime. Property taxes and maintenance tear into any “profit”. I'm cash flowing all of them. Need to be in the right market and buying the right deals. Would you buy land without timber rights if there was a big big discount? r/realestateinvesting. Join. Real Estate Investing. Interested. Raw land is a terrible investment idea unless you plan to earn money off of it, like leasing it for farming or timber. Find someone to do a seller loan carry back and make sure your taxes are low. Then account for the time value of money at a discount rate you. Identify best areas to find your type of Land Investing Asset. I have made great deals on land and I believe that you can, and. Land is not an investment unless it's used or it's location makes it valuable. If the land is cheap how will it increase in value? 4 acres of unfinished land is a horrible deal. You should be able to buy 10 acres or more for that price outside of the town. Upvote 2. If so you can get discounted property with roof damage. Do you know a great wholesaler who can give you deals? Do you have a private money. Land is a very long game that may not even pay off in your lifetime. Property taxes and maintenance tear into any “profit”. I'm cash flowing all of them. Need to be in the right market and buying the right deals. Would you buy land without timber rights if there was a big big discount? r/realestateinvesting. Join. Real Estate Investing. Interested. Raw land is a terrible investment idea unless you plan to earn money off of it, like leasing it for farming or timber. Find someone to do a seller loan carry back and make sure your taxes are low. Then account for the time value of money at a discount rate you. Identify best areas to find your type of Land Investing Asset. I have made great deals on land and I believe that you can, and. Land is not an investment unless it's used or it's location makes it valuable. If the land is cheap how will it increase in value?

While I have not done this, my mom was talked into buying some cheap land across the country in the late 80s or early 90s as an investment. I'd be okay with remote land, like farm land or ranch land, as long as there's reasonable access to a city, and the land is mostly unrestricted. If I were to sell within a few years, it would make more sense to sell as a transaction. Take the money from the sale to invest in a more. Yes, we buy at a discount, otherwise it wouldnt work. 40% is a bit Look at Land Investing Online's YouTube channel and site. I am looking for a resource to learn about land investment. I am not looking for land to build a home on, rather for land as part of. The days of finding a cheap plot for a mountain cabin are long over. Lots of cheap land in the same areas where homesteaders died from broken. Im not aware of any banks are going to lend you 90% for an investment property. You'll need to put % down. Then no PMI so it would probably. I always see listings for and under lots of land everywhere i look. a bunch of them supposedly say theyre fine to put a manufactured home or tiny home on. When I first started real estate investing I looked for cashflow. buying fewer deals, but larger down payment using the money. re: investment, the odds are against cheap land appreciating much in value. It could happen but better assume it won't. Discount lot biz works like this they access public records and send letters to land owners offering to buy lots at ridiculous low amounts. Land is a limited resource so I wanted to invest long term, more than 10 years, into owning land or acreage. Does anyone have ever invested. This has probably been asked before but while reading several books on land investing, I've noticed the authors keep it big picture. Can you buy cheap land, then you change the zoning (from simple Real estate investing “influencers” are starting to make me feel. I am trying to understand how to leverage raw land to use for other investments, ie invest and put downpayments into investment properties. Land is not an investment unless it's used or it's location makes it valuable. If the land is cheap how will it increase in value? 16 votes, 37 comments. M subscribers in the realestateinvesting community. Interested in Real Estate Investing? You've come to the right. If you could go back in time 50 years and buy land as a investment, where would you buy? Land was dirt cheap because it was the middle of. Buying Land to Sell as Investment. Investing. Is buying land for the sole purpose of selling in a few years a good idea? The land is over 10, $8k for a quarter acre in Brevard County FL 6 months ago is already selling for $14k. You want growth for your investments, you want to be in.

When Do You Have To Pay Tax On Crypto

If you earn $ or more in a year paid by an exchange, including Coinbase, the exchange is required to report these payments to the IRS as “other income” via. While purchasing cryptocurrency is not taxable, your crypto gains become taxable when you sell crypto or trade it for another cryptocurrency. Not to mention. Capital Gains Tax & crypto Because crypto is viewed as a capital asset from a tax perspective, anytime you dispose of crypto, you may need to pay Capital Gains. IRS guidance clarifies that cryptocurrencies are taxed as property. Therefore when you dispose of cryptocurrency held as a capital asset (e.g. sell bitcoin. You pay taxes on cryptocurrency if you sell or use your crypto in a transaction, and it is worth more than it was when you purchased it. This is because you. Cryptocurrency is treated like a capital asset and therefore taxed as such. However, the tax rate you are taxed is primarily dependent on how long you have held. You must report income, gain, or loss from all taxable transactions involving virtual currency on your Federal income tax return for the taxable year of the. Crypto is also taxed based on “disposition”, or when you get rid of something by selling, giving, or transferring it. This means that you don't need to pay. When you reinvest your cryptocurrency, you are essentially selling one type of crypto and purchasing another. This is considered a taxable event, even if you do. If you earn $ or more in a year paid by an exchange, including Coinbase, the exchange is required to report these payments to the IRS as “other income” via. While purchasing cryptocurrency is not taxable, your crypto gains become taxable when you sell crypto or trade it for another cryptocurrency. Not to mention. Capital Gains Tax & crypto Because crypto is viewed as a capital asset from a tax perspective, anytime you dispose of crypto, you may need to pay Capital Gains. IRS guidance clarifies that cryptocurrencies are taxed as property. Therefore when you dispose of cryptocurrency held as a capital asset (e.g. sell bitcoin. You pay taxes on cryptocurrency if you sell or use your crypto in a transaction, and it is worth more than it was when you purchased it. This is because you. Cryptocurrency is treated like a capital asset and therefore taxed as such. However, the tax rate you are taxed is primarily dependent on how long you have held. You must report income, gain, or loss from all taxable transactions involving virtual currency on your Federal income tax return for the taxable year of the. Crypto is also taxed based on “disposition”, or when you get rid of something by selling, giving, or transferring it. This means that you don't need to pay. When you reinvest your cryptocurrency, you are essentially selling one type of crypto and purchasing another. This is considered a taxable event, even if you do.

In the US, cryptocurrencies are taxed as property. You pay taxes on gains when you sell, trade, or dispose of them. Short-term capital gains (held less than a. Because there is no immediate gain or loss when owning cryptocurrency, it is not taxed. However, it does have tax implications. Only when you sell the asset and. Charitable crypto donations can be tax deductible. · It's important to stress here that buying cryptocurrency using another cryptocurrency is a taxable event. The capital gains are taxed depending on the length of ownership. If you own the crypto less than 12 months before you sell it, it will be considered short term. You have to pay taxes on any realized gains. That is when you SELL. If your just hold and values goes up then you do not pay taxes on that, only. Taxes are due when you sell, trade, or dispose of cryptocurrency in any way and recognize a gain. For example, if you buy $1, of crypto and sell it later for. Property, Gold, Stocks, Shares, they are all subject to tax when selling to currency (legal tender). I have not heard of anything were swapping one asset for. Be aware, however, that buying something with cryptocurrency also counts as a sale because you're effectively selling a portion of your holdings to cover the. If you receive cryptocurrency as a gift, you won't have any immediate income tax consequences. You may also have the same basis and holding period as the person. Such people are hoping to turn a profit from buying and selling cryptocurrencies. Selling cryptocurrency for a profit is taxed as capital gain while selling for. If you sold crypto you likely need to file crypto taxes, also known as capital gains or losses. You'll report these on Schedule D and Form if necessary. Tax refunds will not be issued in crypto currencies. How to Make a Payment using Cryptocurrency: Begin by accessing Revenue Online. You do not need to log in to. It's viewed as ordinary income and it's subject to Income Tax. This means you'll be taxed at your normal Income Tax rate for your crypto earnings. To figure out. Crypto can be taxed as capital gains or ordinary income. Here are some of the most common triggers. Note that these lists are not exhaustive, so be sure to. The tax rate is % for cryptocurrency held for more than a year and % for cryptocurrency held for less than a year. Wondering how much you'll need to. Do I have to pay Taxes on my Crypto? We are updating the Crypto experience related to Total Gain and Total Return. Please ensure that your app is up to date as. Trading cryptocurrencies are taxed under capital gains taxes in the US. If you hold your cryptocurrency for over 12 months before selling it for another crypto. In general, if you have received cryptoassets as a form of reward then they will usually be taxable. On the other hand, if you receive cryptoassets as an. That means they're treated a lot like traditional investments, such as stocks, and can be taxed as either capital gains or as income. Bookmark our full crypto. How is Bitcoin taxed? · How long have you held your Bitcoin or other cryptocurrencies from purchase to sale? If held for less than a year, any profit may be.

Leadership In Startups

Every founder, everywhere, can use the 9 leadership principles of The Wartime CEO to become even stronger leaders. In good times and in bad. StartUps are specific by their nature and as such require specific leadership approach. Most of the startups build People function as last. Leadership is the backbone of startup success. Effective leaders provide a clear vision, build and manage talented teams, embrace adaptability. At the end of , statistics showed that 82% of startups failed because of bad management and leadership inexperience. I reached out to some growth folks working in leadership positions at other tech companies for help. I found that most planned their work a few weeks out and. Team building and leadership skills are crucial for the success of a CEO. They have to be able to work with people and motivate them to achieve their best. 6 Traits of an Effective Leader · Be Ethical — Let's be clear that the “right” thing isn't just what is in a company's best interest, but what adheres to. Thought leadership is a public relations strategy that enables you to position your company and its subject matter experts as industry thought leaders. While the focus on product-market fit is vital in the early stages of a startup or scale-up, it's essential not to underestimate the significance of leadership. Every founder, everywhere, can use the 9 leadership principles of The Wartime CEO to become even stronger leaders. In good times and in bad. StartUps are specific by their nature and as such require specific leadership approach. Most of the startups build People function as last. Leadership is the backbone of startup success. Effective leaders provide a clear vision, build and manage talented teams, embrace adaptability. At the end of , statistics showed that 82% of startups failed because of bad management and leadership inexperience. I reached out to some growth folks working in leadership positions at other tech companies for help. I found that most planned their work a few weeks out and. Team building and leadership skills are crucial for the success of a CEO. They have to be able to work with people and motivate them to achieve their best. 6 Traits of an Effective Leader · Be Ethical — Let's be clear that the “right” thing isn't just what is in a company's best interest, but what adheres to. Thought leadership is a public relations strategy that enables you to position your company and its subject matter experts as industry thought leaders. While the focus on product-market fit is vital in the early stages of a startup or scale-up, it's essential not to underestimate the significance of leadership.

In this article, we explore various startup leadership styles and their significance, empowering startup leaders to find their approach that aligns with their. The #1 Product Pitfall at a Startup. This first framework is designed to help you avoid the #1 biggest product pitfall I've seen startups face. The article emphasizes the crucial role of middle management in startups. It argues that middle management provides structure, decision-making oversight. Your leadership styles need to evolve as the company grows. If you want to grow and scale: Let go of your expertise. Educate people around you to take over. PDF | This article explores the role of leadership in start-ups and outlines a model of when, why and how leadership behaviour of founder-CEOs. Leaderpreneur: A Leadership Guide for Startups and Entrepreneurs [Vick, Aaron] on maraboom.ru *FREE* shipping on qualifying offers. A 4-month personal leadership program designed that help founders build and expand their capabilities and repertoire to better handle people and leadership-. This course shares the most important lessons learned in 15+ years of leading engineering teams in early-stage and high-growth startup companies. Personalized startup leadership coaching empowers founders and their teams to hone their communication skills, create a vibrant company culture. An interview with Jim Adler about how Toyota Venture AI incorporates thought leadership into the startups they work with. Founders should start to build out their leadership teams once they've completed their series A or initial round of funding. At this point, it's time to. Successful startups find a way to integrate leadership and management effectively, finding a way to balance their core vision and values with sustainable. A skilled and visionary leader can steer a startup towards growth and prosperity, while poor leadership can lead to its downfall. As new leaders of startups embark on their journey of high growth, there is a need for the leader to develop quickly from a small business operator or. Leadership Challenges in Scaling Startups As startups grow and expand, they encounter a myriad of challenges, particularly in leadership. Thought leadership is the use of strategic messaging to convey your specialized knowledge or unique insights in your field or industry. The leader's roles in a Startup Jayson DeMers is founder and CEO of AudienceBloom · Idea maraboom.ru's the leader's job to come up with new directions and new. Leaders and managers can only be compatible if both feel AND agree the leadership model is right for the company. Leadership styles and Startups · Authoritarian or autocratic — the leader tells his or her employees what to do and how to do it, without. Every founder, everywhere, can use the 9 leadership principles of The Wartime CEO to become even stronger leaders. In good times and in bad.

2 3 4 5 6 7