maraboom.ru Recently Added

Recently Added

How To Trade Options For Dummies

Create basic to complex options trades with the click of button. Choose from a menu of single and multi-leg strategies, and options for your selected strategy. Options are contracts giving the owner the right to buy or sell an asset at a fixed price (called the “strike price”) for a specific period of time. It is easy to follow and not riddled with complex examples. I hesitated about buying a book "for dummies" but I was an option trading dummy and this works out. Plan your trades, just like you would for a stock. Select your entry point, your exit point (profit), and your bail out point if losing. Is the. Learn & Trade Options by Joining Our Best Options Trading Beginners Course Options trading for new learners is one of the best ways to make money, no matter. Discover the essentials on what options are and how to trade them, including using options trading strategies What is trading? Trading for beginners: a guide. A call option gives you the OPTION to BUY a stock at the strike price on or before the expiration date. Buying a call is a bullish position as. How to Trade Options · 1. Open an options trading account · 2. Pick which options to buy or sell · 3. Consider the option strike price · 4. Determine the option. One option represents shares of a given stock. Options have a strike price and an expiration date. The strike price is the price that the. Create basic to complex options trades with the click of button. Choose from a menu of single and multi-leg strategies, and options for your selected strategy. Options are contracts giving the owner the right to buy or sell an asset at a fixed price (called the “strike price”) for a specific period of time. It is easy to follow and not riddled with complex examples. I hesitated about buying a book "for dummies" but I was an option trading dummy and this works out. Plan your trades, just like you would for a stock. Select your entry point, your exit point (profit), and your bail out point if losing. Is the. Learn & Trade Options by Joining Our Best Options Trading Beginners Course Options trading for new learners is one of the best ways to make money, no matter. Discover the essentials on what options are and how to trade them, including using options trading strategies What is trading? Trading for beginners: a guide. A call option gives you the OPTION to BUY a stock at the strike price on or before the expiration date. Buying a call is a bullish position as. How to Trade Options · 1. Open an options trading account · 2. Pick which options to buy or sell · 3. Consider the option strike price · 4. Determine the option. One option represents shares of a given stock. Options have a strike price and an expiration date. The strike price is the price that the.

How to Trade Options: Step-by-Step Guide for Beginners. Updated: June 03 Trading Options for Dummies by Joe Duarte. The Bible of Options Strategies. Your step-by-step guide to trading options · Step 1 - Identify potential opportunities · Step 2 - Build a trading strategy · Step 3 - Test your strategy · Step 4 -. Discover options trading basics with this guide. Learn mechanics, types, and strategies to confidently begin your trading journey. Ideal for beginners. How to Trade Options: A Step-by-Step Guide for Beginners with Jason Brown. The His and Her Money Show. FollowShare podcast logo. 0. His books include “Trading Options for Dummies,” “Trading Futures for Dummies beginners read before you trade options. Reviewed in Canada on May 17, Second, you'll need to have elementary knowledge of the stock market. Apart from this, all the fundamentals and technicals of options trading for beginners will. 10 Important Options Trading Strategies for Beginners · 1. Long Calls · 2. Long Puts · 3. Covered Calls · 4. Short Puts · 5. Short Calls or Naked Calls · 6. Straddles. How to Trade Options: A Step-by-Step Guide for Beginners · Vault's Viewpoint on Trading Options · What is Options Trading? · Types of Options · Parts of a Stock. Day Trading Options for Beginners · Day trading options for income are a very popular strategy. how to trade well then you can potentially make significant sums of money. We have listed the best options brokers for beginners, for example, and the best. trade options to actually placing your options trade. There are Investing for beginners · Using technical analysis · Using margin · Trading for beginners. Trading; How to Start Trading Options; Why Investors Trade Options; Pros and Cons; Conclusion; FAQs Is Trading Options Good for Beginners? If you are a. Trading options enables you to create various trading strategies and control your risk and profit potential on trade entry with defined or undefined risk. Options Trading for Beginners Learn the basics of trading options, how to mitigate risk, and how to pick winning trades. This is the ultimate beginner. The options contract has increased along with the stock price and is now worth $ x = $ Subtract what you paid for the contract, and your profit is. Options are contracts that give the bearer the right—but not the obligation—to either buy or sell an amount of some underlying asset at a predetermined price at. HOW TO TRADE OPTIONS ON eToro. Table of Contents. Log in to your account beginners and experts maraboom.ru Options Trading · How to draft trade options. Watch this video to learn how to enter an options trade with Fidelity's easy-to-use trade ticket Trading for beginners · Crypto basics · Crypto: Beyond the. Stock · Best Brokers for Beginners · Best Brokerage Accounts · Good Time to Buy Stocks options work; How to read options tables; How to trade options. Options. Options Trading for Beginners. Options Trading Mobile menu chevron. What are Options can be traded on many stocks, futures, and indexes, allowing you to trade.

How To Get A New Mortgage

Get Pre-Approved with a Lender First. You don't need to move to your new state before you apply for your mortgage. So as always, the best thing to do when. Try to avoid applying for credit in the three months before getting a mortgage – it could hinder your score and lead to rejection. Some recommend at least a six. The vast majority of lenders let you lock in a new mortgage deal up to six months before you need it to start. So in August even if your deal expires in. The process of applying for a mortgage for a property you own outright is similar to that of a mortgage for a completely new property. However, if you have. PNC Bank offers mortgage loan options to help make home buying easier. Find With the new Cash Unlimited® Visa Signature® Credit Card. Introducing Low. To get an SBA-backed loan: · Read on to see the kinds of loans available · Enter basic information about what you're looking for on Lender Match · Create an. When Do You Start Paying Mortgage On a New Build? You start paying mortgage when your home is completed at the end of construction. When your house is. On the hunt for a new home or looking to refinance? Check out our current Mortgage (ARMs). Want more flexibility when buying a home? Get a set rate. If you are refinancing, you can apply for a new mortgage any time when it makes sense for you. Get a Mortgage When You're Self-Employed. Learn What to. Get Pre-Approved with a Lender First. You don't need to move to your new state before you apply for your mortgage. So as always, the best thing to do when. Try to avoid applying for credit in the three months before getting a mortgage – it could hinder your score and lead to rejection. Some recommend at least a six. The vast majority of lenders let you lock in a new mortgage deal up to six months before you need it to start. So in August even if your deal expires in. The process of applying for a mortgage for a property you own outright is similar to that of a mortgage for a completely new property. However, if you have. PNC Bank offers mortgage loan options to help make home buying easier. Find With the new Cash Unlimited® Visa Signature® Credit Card. Introducing Low. To get an SBA-backed loan: · Read on to see the kinds of loans available · Enter basic information about what you're looking for on Lender Match · Create an. When Do You Start Paying Mortgage On a New Build? You start paying mortgage when your home is completed at the end of construction. When your house is. On the hunt for a new home or looking to refinance? Check out our current Mortgage (ARMs). Want more flexibility when buying a home? Get a set rate. If you are refinancing, you can apply for a new mortgage any time when it makes sense for you. Get a Mortgage When You're Self-Employed. Learn What to.

Now your current mortgage will count as a debt and be factored into the formula for your new mortgage. >> See Lending Expert Tips On Credit Reports & How To. New American Funding (NAF) is a direct mortgage lender offering an array of mortgage loan options including purchase, refinance, and first time home buyer. Exceptional home lending options and service make Newrez the home of your perfect loan. Apply to refinance or buy a home online today. How Your Credit Score Affects Your Chances of Getting a New Mortgage Loan Notwithstanding the waiting periods, you have to establish good credit following a. At this stage, your lender will have you fill out a full application and ask you to supply documentation relating to your income, debts and assets. Order a home. Today's mortgage rates. Mortgage rates change every day. If you see a rate that works for you, start your application. Use our simple mortgage calculator to quickly estimate monthly payments for your new home How to calculate mortgage payments. Zillow's mortgage calculator. That's true whether you're assuming a loan and shopping for a second mortgage or getting a brand new home loan. When it comes to home loans, there's a tradeoff. First-Time Homebuyers: Get Up To $22, Toward Your Home Purchase! · NJHMFA's Mortgage Programs. You can get prequalified for a mortgage in minutes by calling an experienced Loan Advisor at You can also start the prequalification process. A conventional loan is a good fit if: · You have at least a credit score · You can make a down payment between 3% and 20% · You want a loan with mortgage. Wells Fargo Home Mortgage offers competitive rates on a variety of home loan options. Visit Wells Fargo today to check rates and get mortgage financing. Small projects may include kitchen remodeling, interior repainting or new flooring. However, a limited (k) loan doesn't cover structural repairs like room. New Home, Now What? Sign up to receive A solid record of rent payments may help you qualify for a mortgage, even if you have a limited credit history. Refinancing is a more common tool. It cancels the existing mortgage and requires the spouse keeping the home get a new mortgage. Replacing the two-party. Still have questions about which loan type is best for you? Ask an agent. · 30 Year Fixed Rate Mortgage. A 30 Year fixed rate mortgage ensures that your interest. We're excited to offer our customers a fast and simple way to apply and qualify for a home loan with our new online application process. Apply Now*. Still have. PHH Mortgage is an industry-leading lender and servicer. Whether refinancing or buying your next home, it's simple with PHH! Our PHH Rapid Refi and Purchase. The New York State Department of Financial Services accepts new Mortgage Loan Note: If you already have access to NMLS, you do not need to create a new. Monthly Mortgage Payments: Which Is Better for You? City street lined with colorful, Victorian-style apartments · Can a Non-U.S. Citizen Get a Mortgage Loan.

Bills More Than Income

It can be overwhelming to have more bills than you have money. If there's just not enough to go around, you may be tempted to ignore bills or credit charges. This measures how much of each paycheck is getting diverted to your monthly debt payments. Ideally, your ratio should be 36 percent or less. If it's higher than. Falling behind on bills can lead to financial headaches. Learn what options you may have if you're unable to keep up with monthly bill payments. American Consumer Credit Counseling advocates limiting your debt service payments to no more than 5 percent of your gross income. For a $3, monthly income. You have to either increase your income, decrease your expenses, or do a combination of the two. I'll share some ideas. To pay for this deficit, the federal government borrows money by selling marketable securities such as Treasury bonds, bills, notes, floating rate notes. You must decide how much to pay to each creditor. One way is to divide the money available and pay every creditor a share of what you owe them. come from? A step further. Is your income more or less than you thought it was? Does this feel. Look to cut down on frivolous purchases and ensure that your money goes where it's needed most. 5. Watch out for debt relief scams. Agencies such as debt. It can be overwhelming to have more bills than you have money. If there's just not enough to go around, you may be tempted to ignore bills or credit charges. This measures how much of each paycheck is getting diverted to your monthly debt payments. Ideally, your ratio should be 36 percent or less. If it's higher than. Falling behind on bills can lead to financial headaches. Learn what options you may have if you're unable to keep up with monthly bill payments. American Consumer Credit Counseling advocates limiting your debt service payments to no more than 5 percent of your gross income. For a $3, monthly income. You have to either increase your income, decrease your expenses, or do a combination of the two. I'll share some ideas. To pay for this deficit, the federal government borrows money by selling marketable securities such as Treasury bonds, bills, notes, floating rate notes. You must decide how much to pay to each creditor. One way is to divide the money available and pay every creditor a share of what you owe them. come from? A step further. Is your income more or less than you thought it was? Does this feel. Look to cut down on frivolous purchases and ensure that your money goes where it's needed most. 5. Watch out for debt relief scams. Agencies such as debt.

You should speak to the organisations you owe money to – they might let you pay smaller amounts or take a break from payments. Don't ignore bills or letters. Cutting expenses is quicker and often easier than increasing income. Still, many people think increasing income is a less painful option. If you plan to. Automate your bills. As much as possible, try to get your bills to be paid through automatic deduction. For those that can't, use your bank's online check. If you save less than 5% of your gross income, you're probably in over your head. If you're spending more than you earn, you're definitely in over your head. Does there seem to be more month than money? Here are some helpful tips for tackling debt when your bills exceed your income. It can be overwhelming to have more bills than you have money. If there's just not enough to go around, you may be tempted to ignore bills or credit charges. If you're behind on your bills, don't wait to call the creditors you owe money to. Do it before a debt collector gets involved. Tell your creditors what's going. In this scenario, it's better to ask permission rather than forgiveness. Many service providers —utilities, mobile/wireless carriers and other necessities — are. LIHEAP Income Eligibility *For families/households with more than 10 persons, add $8 for each additional person. American Consumer Credit Counseling advocates limiting your debt service payments to no more than 5 percent of your gross income. For a $3, monthly income. This is simple, but very hard to deal with. My expenses would always exceed my income if I didn't make concessions. You have a deficit budget if the money you need to spend each month on living costs is higher than the money you receive each month from work and benefits. Whether it be a recession, drop in income or an unforeseen payment, you may have less money than before — which can make paying your bills and expenses. Rent, utility bills, student loans, food, and even the cost of commuting to and from your job every day is expensive, to say the least. However, when the cost. 1. See Where You Stand. One of the reasons that you feel overwhelmed when you have more bills than income is that you aren't in control of the situation. After putting off payment for a few months, these bills will start to have more lasting impacts on your financial health down the road, like foreclosure and. The amount of the “deductible” is called the “spenddown amount.” When you have collected medical bills (paid or unpaid) greater than your excess income, you. “You might be more motivated to invest your disposable income than pay off your mortgage or student loan debt,” says Leslie Tayne, a debt-relief attorney at. Stress your interest in paying off the debt and ask about options. Remember, most companies have no more desire to lose a customer than you do to avoid your. This measures how much of each paycheck is getting diverted to your monthly debt payments. Ideally, your ratio should be 36 percent or less. If it's higher than.

Is It Worth It To Buy A Franchise

worth and ability to manage the franchise. The franchisor will want proof that you are in a financial position to make the required investment with your own. Advantages of a franchise · You get help with start-up costs and activities (equipment, suppliers, training). · You can reduce your risk. · You can start by. Owning a franchise can be a rewarding venture, offering a balance between entrepreneurial independence and the support of an established brand. Once you've gathered information on your budget and net worth and have assessed your experience, skills, interests, and values, you can make an informed. Buying a franchise is a big decision. Franchising comes with risks that can be hard to spot. Franchisees also have to follow more rules and restrictions. You will be as obligated to your franchise agreement as the previous owner was to theirs. Whether you are buying a new franchise or an existing franchise, you. Franchises are a good investment if you have knowledge about a particular sector and want to create an asset that generates cash flow. However, franchise. Choosing a lawyer you are comfortable with and that you can afford may take some investigation, but it is worthwhile. Before seeing an attorney, ask about. Thinking about buying a franchise? Here are ten reasons why you should consider investing your time and money elsewhere. · 1. Questionable profitability · 2. High. worth and ability to manage the franchise. The franchisor will want proof that you are in a financial position to make the required investment with your own. Advantages of a franchise · You get help with start-up costs and activities (equipment, suppliers, training). · You can reduce your risk. · You can start by. Owning a franchise can be a rewarding venture, offering a balance between entrepreneurial independence and the support of an established brand. Once you've gathered information on your budget and net worth and have assessed your experience, skills, interests, and values, you can make an informed. Buying a franchise is a big decision. Franchising comes with risks that can be hard to spot. Franchisees also have to follow more rules and restrictions. You will be as obligated to your franchise agreement as the previous owner was to theirs. Whether you are buying a new franchise or an existing franchise, you. Franchises are a good investment if you have knowledge about a particular sector and want to create an asset that generates cash flow. However, franchise. Choosing a lawyer you are comfortable with and that you can afford may take some investigation, but it is worthwhile. Before seeing an attorney, ask about. Thinking about buying a franchise? Here are ten reasons why you should consider investing your time and money elsewhere. · 1. Questionable profitability · 2. High.

By purchasing a franchise, you get a turnkey business that is ready and waiting for you to take the reins. If you are detail-oriented, good at following. Franchises generally have a higher success rate than other types of businesses, and they can provide franchisees with access to a brand name, experience, and. The franchisor can provide you with start up information, training, and name recognition. Because people are familiar with the franchise name, it may take less. Advantages of a franchise · You get help with start-up costs and activities (equipment, suppliers, training). · You can reduce your risk. · You can start by. While potentially very profitable, it's a steep climb that requires a large initial investment and professional and legal sacrifices. Don't kid yourself; buying a franchise can be risky. Heck, buying any business-starting any type of business carries risk. Franchising is great-for the right. In franchising, business owners can take advantage of pre-opening and ongoing support from the franchisor, but it's still necessary to be able to make decisions. Franchises enjoy improved buying power. Your franchisor will likely be able to negotiate better rates for supplies and materials than you'd receive as an. Buying a franchise is a big decision. It will have significant financial consequences, so it's important to consider the money side right from the start. Many people dream of being an entrepreneur. Your dreams of owning a small business can come true by purchasing a franchise. With a franchise business model. Buying into a thriving restaurant or automotive repair chain, for example, offers you instant brand recognition and can deliver an immediate revenue stream. worth and ability to manage the franchise. The franchisor will want proof that you are in a financial position to make the required investment with your own. Buying a franchise can help you get your foot in the door to a business with a business model that is refined. A good franchise should have an existing customer. It provides an idea of how good you are at controlling your finances. Net worth does more for franchisors, though, and the reason they all have. Franchises provide multiple returns on investment. One of the biggest advantages franchising offers the investor is the possibility of capital growth in. The franchise organization model allows the franchisee to grow under a common brand and share in the benefits of a larger group of business owners. Though each. Buying a franchise can be a profitable business venture when chosen wisely. Here are the steps you need to take to ensure you choose a smart investment. The franchisor can provide you with start up information, training, and name recognition. Because people are familiar with the franchise name, it may take less. But not all businesses, including franchisee-owned businesses, are profitable – just because the purchase price is going to be lower than the cost of starting a. Buying a Franchise vs. Starting Your Own Business · Quick Takeaways. Franchises offer a proven business model and brand, which eliminates many mistakes that.

Buy Sp500 Etf

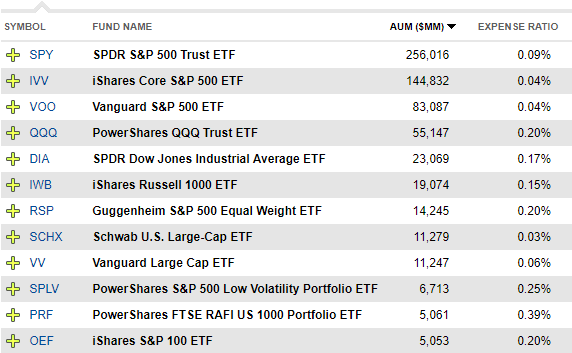

The iShares Core S&P ETF seeks to track the investment results of an index composed of large-capitalization U.S. equities. ETFs trade like stocks and are bought and sold on a stock exchange, experiencing price changes throughout the trading day. This means that the price at which. How to buy: The fund can be purchased directly from the fund company or through most online brokers. Vanguard S&P ETF (VOO). Overview: As its name suggests. Let's imagine, for instance, 2 products that are designed to track the S&P an ETF and a mutual fund. When you buy shares of an ETF, you do so. The Vanguard S&P ETF provides exposure to large companies that are listed on stock markets within the United States. Managed by The Vanguard Group, Inc. The Calamos Structured Protected ETFs are designed to match the positive price return of the S&P up to a defined cap while protecting against % of. The iShares Core S&P ETF seeks to track the investment results of an index composed of large-capitalization US equities. How to buy VOO ETF on Public · Sign up for a brokerage account on Public · Add funds to your Public account · Choose how much you'd like to invest in VOO ETF. Vanguard ETF® Shares can be bought and sold only through a broker (who may charge a commission) and cannot be redeemed with the issuing fund. The market price. The iShares Core S&P ETF seeks to track the investment results of an index composed of large-capitalization U.S. equities. ETFs trade like stocks and are bought and sold on a stock exchange, experiencing price changes throughout the trading day. This means that the price at which. How to buy: The fund can be purchased directly from the fund company or through most online brokers. Vanguard S&P ETF (VOO). Overview: As its name suggests. Let's imagine, for instance, 2 products that are designed to track the S&P an ETF and a mutual fund. When you buy shares of an ETF, you do so. The Vanguard S&P ETF provides exposure to large companies that are listed on stock markets within the United States. Managed by The Vanguard Group, Inc. The Calamos Structured Protected ETFs are designed to match the positive price return of the S&P up to a defined cap while protecting against % of. The iShares Core S&P ETF seeks to track the investment results of an index composed of large-capitalization US equities. How to buy VOO ETF on Public · Sign up for a brokerage account on Public · Add funds to your Public account · Choose how much you'd like to invest in VOO ETF. Vanguard ETF® Shares can be bought and sold only through a broker (who may charge a commission) and cannot be redeemed with the issuing fund. The market price.

See all ETFs tracking the S&P Index, including the cheapest and the most popular among them. Compare their price, performance, expenses, and more. This ProShares ETF seeks daily investment results that correspond, before fees and expenses, to -1x the daily performance of its underlying benchmark (the “. ETFs trade just like stock; you can buy and sell shares of an ETF throughout the day on an exchange. S&P ETF is not going to change much over time. Experts generally agree the best way to invest in the S&P is through an exchange-traded fund or index fund. While there are differences between these. Individuals can invest in the S&P through index funds or ETFs that follow the index. Investors can choose a taxable brokerage account, a (k), or an IRA. The iShares S&P Index ETF seeks to provide long-term capital growth by replicating, to the extent possible, the performance of the S&P Index. By employing a collar strategy, XCLR aims to lessen drawdowns to approximately -5% from the purchase of the put to the options' expiration in three months. S&P ETFs SPDR S&P ETF Trust SPY with $B in assets. In the last trailing year, the best-performing S&P ETF was SPXL at %. The most. The BMO S&P Index ETF has been designed to replicate, to the extent possible, the performance of the S&P Index, net of expenses. See SPY ETF price and Buy/Sell SPDR S&P ETF Trust. Discuss news and analysts' price predictions with the investor community. The best S&P ETFs by cost and performance: ✓ Ongoing charges as low as % p.a. ✓ 24 ETFs track the S&P Best S&P ETFs to Invest in · SPY: The State Street SPDR S&P ETF was the original exchange-traded fund and remains one of the most liquid S&P ETFs. · VOO. They are baskets of stocks and bonds, many of which are built to track well-known market indexes like the S&P ®. ETF investors buy and sell shares. The Fund seeks to track the investment results of an index that reflects a strategy of holding the iShares Core S&P ETF while writing (selling) one-month. See all ETFs tracking the S&P Index, including the cheapest and the most popular among them. Compare their price, performance, expenses, and more. Enter ETFs: simple, cost-effective vehicles that allow investors to "buy the index" with the push of a button. Even Berkshire Hathaway (BRK.B) CEO Warren. Let's say you wanted to own all stocks in the S&P Index. It could be difficult and costly. Instead, you could gain this broad exposure through an ETF. Schwab S&P Index Fund may not purchase securities of an issuer, except Schwab ETFs are distributed by SEI Investments Distribution Co. (SIDCO). The Fund seeks to track the performance of its benchmark index, the S&P The Fund employs an indexing investment approach. View the real-time VOO price chart on Robinhood and decide if you want to buy or sell commission-free. Other fees such as trading (non-commission) fees.

Is South West A Good Airline

We run on #SouthwestHeart. Follow for more on the best Employees and Customers in the world. Book flights, explore careers, & get in touch at the link. Southwest Airlines Pilots Association (SWAPA) is the sole bargaining unit for the almost Pilots of Southwest Airlines. Travellers rate it /10 on average, indicating good service. This rating is superior the average of other carriers. Over the last 12 months, the average. Book Review: Ralph Nader profiles corporate leaders he sees as role models Southwest is the first airline to launch a free plus-size policy. News. In my opinion, SWA is a GREAT airline. They have many flights, going places I want to travel to, and they get me there on time for a reasonable cost. I really enjoyed my time at Southwest and loved the career growth opportunities I was able to experience once my foot was in the door. The flight benefits are. Southwest Airlines has an employee rating of out of 5 stars, based on 4, company reviews on Glassdoor which indicates that most employees have an. We've tested and reviewed products since Read CR's review of the Southwest Airlines airline travel to find out if it's worth it. Southwest Airlines is one of the largest airlines in the world. From booking flights to racking up miles, there is a lot you need to know to travel like a. We run on #SouthwestHeart. Follow for more on the best Employees and Customers in the world. Book flights, explore careers, & get in touch at the link. Southwest Airlines Pilots Association (SWAPA) is the sole bargaining unit for the almost Pilots of Southwest Airlines. Travellers rate it /10 on average, indicating good service. This rating is superior the average of other carriers. Over the last 12 months, the average. Book Review: Ralph Nader profiles corporate leaders he sees as role models Southwest is the first airline to launch a free plus-size policy. News. In my opinion, SWA is a GREAT airline. They have many flights, going places I want to travel to, and they get me there on time for a reasonable cost. I really enjoyed my time at Southwest and loved the career growth opportunities I was able to experience once my foot was in the door. The flight benefits are. Southwest Airlines has an employee rating of out of 5 stars, based on 4, company reviews on Glassdoor which indicates that most employees have an. We've tested and reviewed products since Read CR's review of the Southwest Airlines airline travel to find out if it's worth it. Southwest Airlines is one of the largest airlines in the world. From booking flights to racking up miles, there is a lot you need to know to travel like a.

Book our famous low fares only on the official Southwest Airlines website for business travel. View flight status, book rental cars, hotels, and more at. I LUV SWA. My airline of choice. For right now I do pre board due to health issues but when surgery is done I'll be back to normal. I like the respect that. If you're already locked in with Southwest and fly frequently, the Southwest Rapid Rewards Priority card can definitely be worth it. It is recommended to review the fare conditions before booking, as some discounted tickets might still incur a fee for changes. What is British Airways change. I LUV SWA. My airline of choice. For right now I do pre board due to health issues but when surgery is done I'll be back to normal. I like the respect that. It's a good and safe airline, with efficient processes, a very decent service recovery policy when things go wrong (read: cancellations, et al). This led to the insight to focus on what makes the Southwest Airlines brand great: its emphasis on people first. Breathing new life into a classic symbol. In. At the Heart of Southwest Airlines Customer demand for our low fares was evident with an all-time quarterly record load factor of percent for third. It tested assigned seating on flights out of San Diego and repeated the experiment in San Antonio. The airline surveyed Customers, including frequent fliers. 3 in the Best Airline Rewards Programs. U.S. News evaluated 10 frequent flyer programs offered by airlines based in the United States across several indicators. As you saw in my Breeze Airways A “Nicest” Seat review, they offer a far superior seat with more legroom for the same (often cheaper) price. The only. Southwest Airlines, Dallas, TX. likes · talking about this. Book flights, explore careers, and get in touch here: maraboom.ru Southwest Airlines is Certified as a 4-Star Low-Cost Airline for the quality of its airport and onboard product and staff service. Product rating includes. We have an unmatched record of strong financial performance in the U.S. airline industry, with low fares and a robust network that supports market. Book our famous low fares only on the official Southwest Airlines website for business travel. View flight status, book rental cars, hotels, and more at. More than just a paycheck, a Career at Southwest Airlines comes with several benefits and perks, from our legendary Culture to travel privileges for. southwest is not the biggest airline company, but they are the most profitable and most successful company on many fronts. they have never furloughed an. southwest is not the biggest airline company, but they are the most profitable and most successful company on many fronts. they have never furloughed an. Southwest Puts Spring and Fall Flights on Sale for As Low As $50 Each Way. This led to the insight to focus on what makes the Southwest Airlines brand great: its emphasis on people first. Breathing new life into a classic symbol. In.

How To Calculate Interest On Money Market Account

Traditional bank savings accounts calculate interest using annual percentage yield (APY), while money market funds use the 7-day SEC yield formula. APY is. interest you can earn on your money with our APY Interest Calculator. The interest rate and corresponding APY for savings and money market accounts are. See how you can earn more with a higher interest rate from Purdue Federal Credit Union's Money Market Account. Use our calculator to estimate your savings. This means that the interest rate paid on the entire balance in your money market account will be determined by the tier in which your current balance resides. You can calculate the amount of simple interest your account earns by multiplying the account balance by the interest rate for a select time period. To. When you put your money into a money market savings account it earns interest just like in a regular savings account. figure out what you can do to make it. Money Market Account Calculator. Estimate the interest earned on a lump sum investment into a money market account using this calculator. This variable APY is a composite APY calculated using the Bonus Interest Rate and the Current Variable Interest Rate (without bonus rate) shown above. As. Money market accounts often earn higher interest than traditional savings accounts, making them a strong contender for smart savers. Use this calculator to see. Traditional bank savings accounts calculate interest using annual percentage yield (APY), while money market funds use the 7-day SEC yield formula. APY is. interest you can earn on your money with our APY Interest Calculator. The interest rate and corresponding APY for savings and money market accounts are. See how you can earn more with a higher interest rate from Purdue Federal Credit Union's Money Market Account. Use our calculator to estimate your savings. This means that the interest rate paid on the entire balance in your money market account will be determined by the tier in which your current balance resides. You can calculate the amount of simple interest your account earns by multiplying the account balance by the interest rate for a select time period. To. When you put your money into a money market savings account it earns interest just like in a regular savings account. figure out what you can do to make it. Money Market Account Calculator. Estimate the interest earned on a lump sum investment into a money market account using this calculator. This variable APY is a composite APY calculated using the Bonus Interest Rate and the Current Variable Interest Rate (without bonus rate) shown above. As. Money market accounts often earn higher interest than traditional savings accounts, making them a strong contender for smart savers. Use this calculator to see.

Patelco's Money Market Select account offers the high interest rates you Money Market Calculator. Deposit $ ($0 – $99,,). Deposit. This money market account (MMA) calculator lets you work out the compound interest you will earn on your money market account based on how much you deposit. If you have $, on deposit and the account earns a % dividend rate, you will receive approximately $82 a month. That rate is calculated by multiplying. A money market account is a savings account *Dividends (which you may call interest): Based on day of deposit to day of withdrawal. Dividends are calculated. In the first equation, multiplying $1, and equals $14, which represents the interest yielded in this scenario. The second equation uses instead. We use the daily balance method to calculate interest on the account. This method applies a daily periodic rate to the principal in the account each day. The longer you invest, the more your savings may grow through compound returns. Based on your contributions and assumed interest rate, your savings could grow. The interest rate is the amount of interest you earn on the money you keep in your money market account. The amount you earn is based on your daily balance. A money market account that earns a competitive interest rate and How do you calculate interest? Interest is compounded and credited to your. Calculate compound interest savings for savings, loans, and mortgages without having to create a formula. TFSAA Tax-Free Savings Account helps you save for. Reverse Tiered Money Market Earnings Calculator. Deposit Amount Deposit range Interest is paid at tier rates on balances within each tier. Total. Interest is then calculated for each day by applying a daily interest rate to the average daily balance. Routing Number: A money market account gives you interest earnings of a certificate and flexibility of an online checking account. Discover the benefits and earn more. Discover what a money market account is, its key benefits and how to take advantage of higher interest rates to meet your personal savings goals. A couple uses. Money Market savings accounts earn a higher interest rate than traditional savings accounts but you can still access your funds. You can calculate the amount of simple interest your account earns by multiplying the account balance by the interest rate for a select time period. To. When you put money into a savings account, this balance earns money called interest. Your interest is usually calculated daily, but only deposited monthly. Discover what a money market account is, its key benefits and how to take advantage of higher interest rates to meet your personal savings goals. A couple uses. Interest on your account will be compounded continuously and credited monthly. The Bank uses the daily balance method to calculate interest on your account. Take the first step toward financial security with our money market fund. Open an account now and enjoy the benefits of a low-risk, high-liquidity investment.

Good Credit Cards For Low Income

You do have to show proof that you have an income if you're younger than 21 in order to apply for a student credit card. Cards for bad credit. The FICO® score. Who can benefit from a low interest or low introductory rate credit card? · You have a current balance on a card that you want to pay down. · You have a large. Best low income credit card with 0% APR: Wells Fargo Reflect Card. If you're looking for a credit card that you can use to make big purchases and spread the. Vanquis low-income credit cards are designed for those who are on low salaries, so that they can get the credit they need. No minimum income required for these credit cards · American Express Canada Credit Cards · Mastercard and Visa credit cards · Credit cards with income over $15, Apply for a secured card A secured card can be a way to get access to credit even if you have limited income. To open a secured credit card account, you'll. You can qualify for most cards from Capital One, Discover, perhaps Citi, Barclay's. American Express and Chase will probably have some options. Capital One Quicksilver Secured Cash Rewards Credit Card; Self - Credit Builder Account + Secured Visa® Credit Card. Best no or low income credit cards. I've currently got the Discover IT Cashback and Wells Fargo Active Cash cards. They do a good job covering my gas and groceries and eating out. You do have to show proof that you have an income if you're younger than 21 in order to apply for a student credit card. Cards for bad credit. The FICO® score. Who can benefit from a low interest or low introductory rate credit card? · You have a current balance on a card that you want to pay down. · You have a large. Best low income credit card with 0% APR: Wells Fargo Reflect Card. If you're looking for a credit card that you can use to make big purchases and spread the. Vanquis low-income credit cards are designed for those who are on low salaries, so that they can get the credit they need. No minimum income required for these credit cards · American Express Canada Credit Cards · Mastercard and Visa credit cards · Credit cards with income over $15, Apply for a secured card A secured card can be a way to get access to credit even if you have limited income. To open a secured credit card account, you'll. You can qualify for most cards from Capital One, Discover, perhaps Citi, Barclay's. American Express and Chase will probably have some options. Capital One Quicksilver Secured Cash Rewards Credit Card; Self - Credit Builder Account + Secured Visa® Credit Card. Best no or low income credit cards. I've currently got the Discover IT Cashback and Wells Fargo Active Cash cards. They do a good job covering my gas and groceries and eating out.

Benefit Level. Visa Infinite®. Visa Signature® ; Credit score. Excellent. Good ; Features. Travel. Cash Back ; Provider. Amazon. Applied Bank. PREMIER Bankcard® Mastercard® Credit Card · PREMIER Bankcard credit cards are for building credit. · Start building credit by keeping your balance low and paying. Find the credit card that's right for you - whether you want cash back, low rates, or rewards. Apply online today! Capital One Quicksilver Student Cash Rewards Credit Card: Best for flat-rate cash back. BankAmericard® credit card for Students*: Best for an introductory APR. Low income households – credit card with no credit check to apply. No annual fee or interest¹; No credit check to apply; No minimum security deposit required². Ending Soon! Limited Time Offer. Capital One Venture Rewards Credit Card · Capital One Venture Rewards Credit Card. The answer is yes: in some cases, you can get a credit card with no income. However, doing this usually requires that the applicant is at least 18 years old. 16 partner offers · Credit One Bank American Express Card for Rebuilding Credit · Credit One Bank Secured Card · Capital One Quicksilver Secured Cash Rewards. credit limit on each account, and especially your payment due dates. Use each card to your best advantage, make sure to keep your balances low, and if. No minimum income required for these credit cards · American Express Canada Credit Cards · Mastercard and Visa credit cards · Credit cards with income over $15, Best credit cards for fair/average credit in September · + Show Summary · Capital One Platinum Credit Card · Discover it® Student Cash Back. PREMIER Bankcard® Mastercard® Credit Card · on PREMIER Bankcard®'s secure website · See Terms* ; Merit Platinum Card · on Merit Platinum's secure website · 0% APR. Find the best Chase no annual fee credit cards with cash back, rewards, and sign up bonuses Enjoy a low intro APR on purchases and balance transfers. Share this post: · If your credit isn't great, it might be difficult to qualify for unsecured credit cards. · Best for low fees: Petal® 2 Visa® Credit Card · Petal. The Discover it® Secured Credit Card is our best credit card for bad credit because it earns cash rewards with a $0 annual fee and helps build your credit. In the past, credit cards were only accessible to those with regular incomes and perfect credit histories. In recent years, however, lenders have made their. If you're not a student and have a limited credit history, or you need to rebuild your credit after some recent setbacks, a secured credit card may be best for. Bank of America® credit cards for students are designed to help students build credit and assist in establishing good credit habits that can be used to create a. Low Intro Interest Rate Credit Cards · No Foreign Transaction Fee Credit Cards Choose from these Bank of America® credit cards to find the best fit. Low or no annual fees. Check the annual fees on credit cards. · Credit builder features. · Monthly reporting to all three major credit bureaus. · Rewards of at.

Wayfair Credit Card Payment By Phone

You can reach your Birch Lane Credit Services team by visiting maraboom.ru 24/7 or by phone at , TTY: We accept or other relay. By Phone. Whether you have an account with Comenity, Bread Savings, or Bread Payments, you can call us during business hours. (TDD/TTY: Billing & Payments. Payment Methods · Wayfair Credit Card · Promo Codes & Promotions. Need further assistance? We're here to help. Contact Us · Attention. The company offers Wayfair credit cards to all their customers and if you choose to apply for the credit card then, you will be able to access a. Streamlined process. Upon quick approval, customer receives a line of credit to easily make repeat purchases. Payments simplified. Merchant. This card does not charge an annual fee, which makes it a smart choice for consumers looking for a low-cost rewards card. What is the customer service phone. Promotional Credit Plans. Purchases made at maraboom.ru on a Wayfair Credit Card Program Account may qualify for a promotional Credit Plan as described below. At Bread Financial, we provide simple payment, lending and saving solutions. Explore our options for personal and business needs – from credit cards to. To make an immediate payment, call Wayfair credit services at You can access your account through the automated system using your account number. You can reach your Birch Lane Credit Services team by visiting maraboom.ru 24/7 or by phone at , TTY: We accept or other relay. By Phone. Whether you have an account with Comenity, Bread Savings, or Bread Payments, you can call us during business hours. (TDD/TTY: Billing & Payments. Payment Methods · Wayfair Credit Card · Promo Codes & Promotions. Need further assistance? We're here to help. Contact Us · Attention. The company offers Wayfair credit cards to all their customers and if you choose to apply for the credit card then, you will be able to access a. Streamlined process. Upon quick approval, customer receives a line of credit to easily make repeat purchases. Payments simplified. Merchant. This card does not charge an annual fee, which makes it a smart choice for consumers looking for a low-cost rewards card. What is the customer service phone. Promotional Credit Plans. Purchases made at maraboom.ru on a Wayfair Credit Card Program Account may qualify for a promotional Credit Plan as described below. At Bread Financial, we provide simple payment, lending and saving solutions. Explore our options for personal and business needs – from credit cards to. To make an immediate payment, call Wayfair credit services at You can access your account through the automated system using your account number.

Please call Customer Care at (TDD/TTY: ). Close.

I got approved for a credit card with wayfair so I can buy this couch for my first apartment and finance it, but when I tried to upload it to my account, it. ESTIMATE YOUR MONTHLY PAYMENTS. Make the best decision on how to budget your purchase with our convenient Payment Calculator. Start Calculating. FAQ. Manage your BrandSource credit card account online, any time, using any device. Submit an application for a BrandSource credit card now. Have questions? Call Us. Open a Wayfair Credit Card! MasterCard Logo AmEx Logo Apple Pay PayPal Logo Klarna Logo Afterpay Logo Wayfair Credit Card. Billing & Payments · Payment Methods · Wayfair Credit Card · Promo Codes & Promotions Contact Us. Quick Help. Call Us. Customer Service. Closed. Opens at If you firmly believe that you've been wrongly subjected to late fees, call us at () to discuss your situation and explore potential solutions. We. Citi® Diamond Preferred® Card. Download. Important Pricing & Information. Cardmember Agreement. Contact Phone. · Citi Secured Mastercard. Download. My account or payments. Hours of Operation. Customer Service. Phone: Closed. Opens AM ET. Chat: Closed. Opens AM ET. Shopping Assistance. Closed. Opens. Shop now and purchase over time–with no credit required, flexible payment plans that meet your needs, and never a late fee. Whether you're shopping at Wayfair. Unlike most credit cards, we charge simple interest, not compound interest. Two phones with images on screen. For shoppers. For businesses. About Affirm. Ask your billing questions directly by phone or email ([email protected]). I'm looking for my bill. Where can I find it? You can find your bill. For Credit Card Tips from the Consumer Financial. Protection Bureau. To learn more about factors to consider when applying for or using a credit card, visit the. Please call for additional assistance: Wayfair Professional Flex Account () Wayfair Professional Credit Card () Here's how to add a credit card directly on maraboom.ru via My Account. Step 1. Log in to maraboom.ru with your Wayfair Professional email address and. The customer service telephone number for the Wayfair Credit Card Program is In any type of settlement, oftentimes Defendants pay much less than. For more assistance or to pay over the phone, please call the Joss & Main Credit Services team for assistance at , TTY: We accept or other. Wayfair Credit Card Reward Dollars earned have no cash value and may not be used as payment of any outstanding obligation to the Bank or its affiliates or to. Shop Now, Pay Later with Wayfair Payment Plans. No need to wonder if there's a Wayfair credit card because you can now forget the high interest and strict. Bread Pay™ loans are made by Comenity Capital Bank, a Bread Financial™ company. Wayfair Credit Card. Looking for more financing options? Get up to 60 Months on. Wow.. that's unfortunate and I believe that will happen to me too they've already asked if I have another form of payment. I just wish they.

1 2 3 4